Next: Derivation

Up: An Analysis of Option

Previous: Black-Scholes formula

Contents

The other model that was tested was the Cox, Ross, & Rubenstein binomial tree model. Consider a

MSFT 50 call when the stock is at trading at $50 10 days before expiration. For each of the ten

remaining days prior to expiration, we assume that the stock can move in two directions: up 2% or

down 2%. We then repeat this for each day until we reach the expiration date in 10 days, and the

tree will consist of 1024 leaves, all possible outcomes of the stock price movement in the 10 days

prior to expiration. At this point, calculate the option value at expiration for each of these

combinations. One can then work backwards, calculating the value of each parent node by using the

following formula:

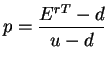

![$\displaystyle f = E^{-rT}[pf_{u} + (1-p)f_{d}]$](img3.png) |

|

|

(3) |

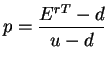

where

|

|

|

(4) |

Subsections

Charles Vu

2003-06-12