| (1) |

| (1) |

|

(2) |

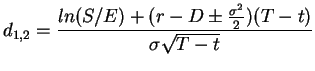

The derivation of Black-Scholes is rather complex. I will not be studying the theoretical validity of this model; rather, I will look at whether it accurates prices options in the real market. If one is interested in the derivation of the Black-Scholes formula, see http://www.lifelong-learners.com/opt/SYL/s4node10.php3